Who’s Liable if I’m Involved in an Accident with a State Highway Vehicle?

The majority of car accidents that occur in Alabama involve private citizens who are driving their personally-owned vehicles. As such, when a crash occurs, the responsible driver’s insurance is responsible for paying compensation to the other from the policyholder’s liability insurance.

But what happens when an accident is caused by a state highway vehicle, such as a highway patrol vehicle? Police and other government vehicles cause hundreds of accidents per year throughout the United States. In fact, police chases alone kill more people every year than do floods, hurricanes, tornadoes, and lightning combined.

If you’re involved in an accident with a state highway vehicle, here’s a look at what you need to know about liability, filing a claim, and getting the compensation you’re owed after a crash.

Alabama Sovereign Immunity Laws

State sovereign immunity laws are meant to protect states from liability in the event that they – or any of their agents or employees – engage in negligence or negligence per se (the breach of a code or statute) that leads to harm of another party. Many states in the nation have waived their sovereign immunity rights, allowing injured citizens to pursue negligence-based claims against states, often with limitations (i.e. reduced statutes of limitations, caps on damages, etc.), but Alabama is not one of them. The constitution of the state of Alabama explicitly reads that the state “shall never be made a defendant,” alluding to the state’s strong sovereign immunity laws.

Alabama General Liability Trust Fund

Despite the state’s protections, Alabama has established a General Liability Trust Fund and Employee Auto Liability Program, which provides insurance coverage for negligent or wrongful acts of state employees (the state itself is immune from tort actions). The Alabama Division of Risk Management explains that the program is designed to provide protection for employees who are operating state vehicles (or personal vehicles) within the course of their job description and are involved in an accident.

How Much Is Provided in Coverage?

The Employee Auto Liability Program provides liability coverage of up to $1,000,000 for both property damage and bodily injury per accident. This means that even if there are three people injured in your vehicle during the time of a crash, the $1,000,000 limit is not extendable – $1,000,000 is the maximum amount recoverable regardless of the number of injured parties or the extent of property damage.

What Do I Have to Prove?

Remember, Alabama is an at-fault car insurance state. While this means that if you are involved in an accident with a state highway vehicle, liability insurance to pay for your injuries will most certainly be in place, it also means that you will have to prove fault in order to recover damages. If you are found to be partially at fault for the crash, you may be barred from recovery.

The Importance of Working with an Experienced Car Accident & Government Claims Lawyers

The laws regarding sovereign immunity in the state of Alabama are especially complex and difficult to understand. What’s more, there are different requirements for each type of government claim – for example, a claim against a municipality must be filed within six months, and a claim against a county must be filed within 12 months. Further, damages in a claim against a government entity (municipality or county) in Alabama are capped at $100,000 per claimant and $300,000 per occurrence (see: Alabama Code Section 11-92-2). Because the state cannot be made a defendant, understanding against whom to file a claim when a state highway vehicle causes a crash can be elusive, and you may feel overwhelmed by the process.

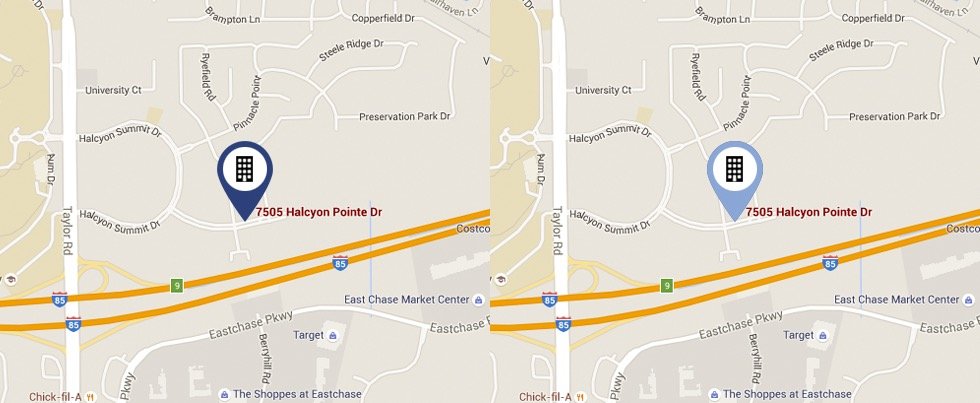

At the firm of Chip Nix Attorney at Law, our experienced government tort attorneys know how frustrating sovereign immunity can be, and understand that when you’re injured, you deserve to be compensated regardless of whether the at-fault person is a government employee. If you are ready to schedule a free consultation to learn more about your options today, call our offices directly at (334) 279-7770. You can also use our online form to get in touch and tell us more about what you’re going through.