The Truth About Pre-Settlement Lawsuit Loans

You have a strong lawsuit, but you are pre-settlement. The money will be forthcoming as soon as you make it through the various phases of your personal injury claim. But that could take months or even years!

The problem is you need cash, and you need it now to pay bills and stay afloat.

There is no shortage of lawsuit lenders to fit the bill. They will provide you with immediate cash to pay your bills and take some of the stress off of your life. You are told you can have your much-needed money in a day or two.

That may sound like an easy solution, until it comes time to pay them back!

Pre-Settlement Lawsuit Loans

It is important to understand that even though your lawyer knows you have a good case, they cannot provide you with an advance on your settlement.

So, the lawsuit lenders are the next step. Also known as “lawsuit funding,” “settlement funding,” or “lawsuit cash advances,” the money can be used for whatever you need, such as a mortgage payment, car loan, living expenses, or medical bills.

Assuming you eventually get your cash, have you calculated just how much the interest that you will pay on your lawsuit loan?

Lenders must tell you the interest rates on the money they are lending, but the interest rates on these loans can be obscene.

You will be told that since there is no assurance you will even receive a settlement the lender may never see the money. This is what is known as a non-recourse lawsuit loan, meaning you do not have to pay the loan if you do not win your case. If you do eventually win your settlement, you are facing an exorbitantly high-interest rate when you pay the loan back.

From the lender’s perspective, they are likely to choose less risky cases to invest their money. They prefer to invest in cases where a settlement or jury verdict is highly likely, such as a case in which the liability for the injury is already established.

This is a largely unregulated industry compared to banks or credit unions, and it is not uncommon for the lender to take advantage of the accident victim.

Typically, the interest rates on these loans run between 27% and 60% a year. This means that borrowing $25,000 can cost you half of that amount or more in just one year.

While some states cap the interest rates in pre-settlement advances, Alabama is not among them.

Alternatives to Legal Lenders

Instead of going to a lawsuit lender, consider borrowing from friends, relatives or even taking cash advances on your credit cards. Credit cards will let you take out cash advances often at a significantly lower interest rate than you will pay with a pre-settlement loan.

A neighborhood bank or credit union may advance you an installment loan which will likely cost you less over time. You might also borrow against the equity in your house, but that should be a last resort if you do not win your case.

The trade association for legal lenders is called American Legal Finance Association (ALFA), and they issue a list of best practices for members. Make sure the company you are considering publishes a full disclosure of lending rates, additional fees, pre-payment penalties, how often the interest is compounded, and whether these numbers vary with the amount borrowed.

There is a great deal of variation in the interest rate on lawsuit loans. You may find a lender with reasonable rates who discourages you from taking a large loan, just what you need to get by, and fully discloses what to expect. When deciding whether or not a pre-settlement lawsuit loan is a good idea, it is always a good idea to ask your lawyer for their advice.

Your Alabama Personal Injury Attorney

Finding an alternative to a lawsuit loan will mean there is more money in your pocket when your case is concluded. But unfortunately, some folks just need cash, and they have few alternatives.

Understand that these loans can sometimes be negotiated down at the end of the day, mainly if the interest on the loan has caused it to swell to an unfathomable number that even the lender has trouble justifying.

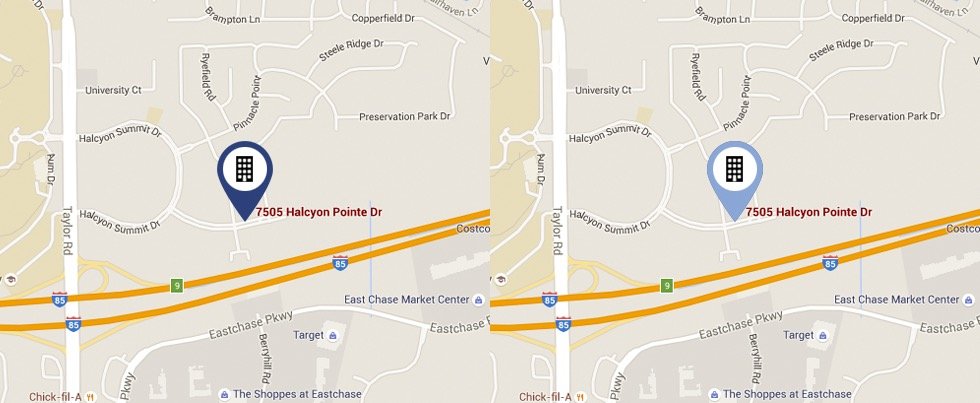

Chip Nix, Attorney at Law, offers you invaluable experience in representing those injured in personal injury claims in Alabama. He will be glad to answer any questions you have about your case during a free initial consultation when you call our Montgomery office at 334-203-6669.

Sources:

NOLO Law

https://www.nolo.com/legal-encyclopedia/how-shop-lawsuit-loan.html

Al.com

https://www.al.com/opinion/2017/02/lawsuit_loans_put_victims_last.html

AL Consumer Credit

https://banking.alabama.gov/pdf/laws/AL_MC_Act.pdf